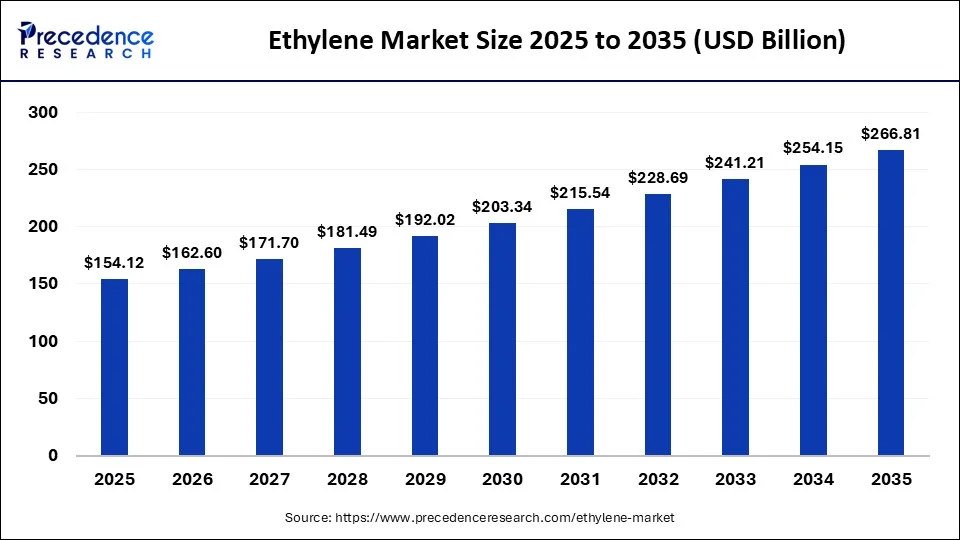

Ethylene Market Size Forecasted to Reach USD 266.81 Billion by 2035 Driven by Packaging and Polyethylene Demand

The ethylene market size surpassed USD 154.12 billion in 2025 and is expected to reach around USD 266.81 billion by 2035, growing at a CAGR of 5.64% from 2026 to 2035. The increased production of agricultural films and growing packaging applications drive the ethylene market growth.

Ottawa, Feb. 13, 2026 (GLOBE NEWSWIRE) -- According to Precedence Research, the global ethylene market size will grow from USD 162.60 billion in 2026 to nearly USD 266.81 billion by 2035, expanding at a significant CAGR of 5.64% between 2026 and 2035.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/2300

Ethylene Market Key Takeaways

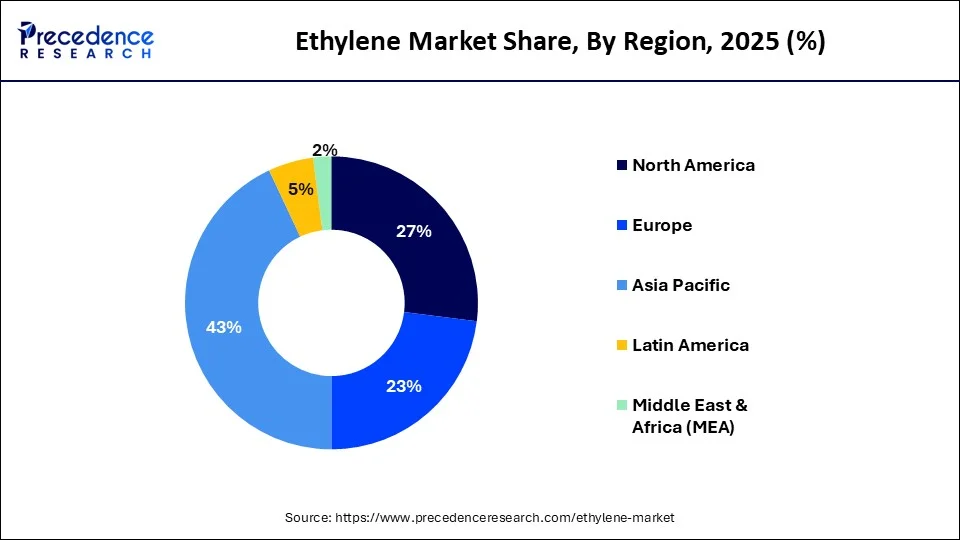

- Asia Pacific led the global market, accounting for approximately 43% of total revenue in 2025.

- By application, the polyethylene segment dominated, capturing 57% of the market revenue in 2025.

- By end use, the packaging industry held the largest share, representing 51.8% of overall revenue in 2025.

What is Ethylene?

The ethylene market growth is driven by the growing plastic demand, rapid industrial growth, increased production of plastic components, high consumption of packaged goods, growing electronics use, increased production of ethylene oxide, and the development of medical devices.

Ethylene is a flammable hydrogen gas with the chemical formula C2H4. It has a sweet smell and is lighter than air. Ethylene is highly flammable and soluble in non-polar solvents. It is widely used for the synthesis of organic chemicals and the production of polymers. Ethylene is widely used in applications like fruit ripening, sprout suppression, refrigerant, ethylene oxide production, packaging films, and welding.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Government Initiatives for the Ethylene Industry:

- South Korea's Cracker Consolidation Initiative: The government and 10 major petrochemical firms agreed in late 2025 to reduce ethylene capacity by up to 3.7 million tonnes per year through consolidations and operating rate reductions to address regional oversupply.

- India’s Ethanol Blended Petrol (EBP) Programme: This initiative has advanced its 20% ethanol blending target to 2025, driving massive investment in bio-ethylene and bio-based feedstocks to reduce fossil fuel dependence.

- China's "Oil Reduction and Chemical Increase" Plan: The government's 2025 growth stabilization plan strictly regulates new ethylene capacity while promoting "AI + Petrochemicals" digital transformations and energy-saving upgrades for existing facilities.

- The European Union’s Fit for 55 Policy: This regulatory framework mandates a 55% reduction in emissions by 2030, forcing steam crackers to adopt electrification and renewable energy to maintain global competitiveness.

-

Canada’s Federal Low-Emission Technology Grants: The government manages multiple incentive programs and grants, such as a $9.5 million investment in 2025 for carbon capture and storage projects specifically targeting petrochemical decarbonization.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2300

What are the Key Trends of the Ethylene Market?

- Accelerated Decarbonization and Bio-Ethylene Adoption: Industry leaders are increasingly investing in bio-based feedstocks and carbon capture to meet stringent global net-zero targets and environmental regulations. This shift is driving the growth of the bio-based ethylene market, which is projected to double in value between 2025 and 2032 as companies transition from traditional fossil-derived production.

- Persistent Global Oversupply and Capacity Rationalization: Aggressive capacity expansions in China and the United States have outpaced demand growth, leading to a projected market glut through at least 2026. In response, high-cost regions like Europe and South Korea are being forced into structural asset rationalization, including the permanent shutdown or consolidation of older steam crackers.

Built for leaders who move markets. Access live, actionable intelligence with Precedence Q. https://www.precedenceresearch.com/precedenceq/

Ethylene Market Opportunity

Surging Electronics Demand Unlocks Market Opportunity

The high rate of electronics manufacturing and the increasing use of electronic components in electronic devices increase demand for ethylene. The increased manufacturing of lithium-ion batteries and the increasing use of capacitors increase demand for ethylene. The rising manufacturing of semiconductors and the increasing need for insulating materials create a higher demand for ethylene.

The development of high-performance cables and the higher penetration of electronic devices increases demand for ethylene. The increasing use of protective films in electronic devices and the popularity of printed electronics creates higher demand for ethylene. The surging electronics demand creates an opportunity for the growth of the ethylene industry.

Get informed with deep-dive intelligence on AI’s market impact https://www.precedenceresearch.com/ai-precedence

Ethylene Market Scope

| Report Metrics | Details |

| Market Size in 2025 | USD 154.12 Billion |

| Market Size in 2026 | USD 162.60 Billion |

| Market Size by 2035 | USD 266.81 Billion |

| Growth Rate (2026 – 2035) | 5.64% CAGR |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Source, Feedstock, Application, End-Use, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

➤ Access the Full Ethylene Market Study @ https://www.precedenceresearch.com/ethylene-market

Ethylene Regional Insights

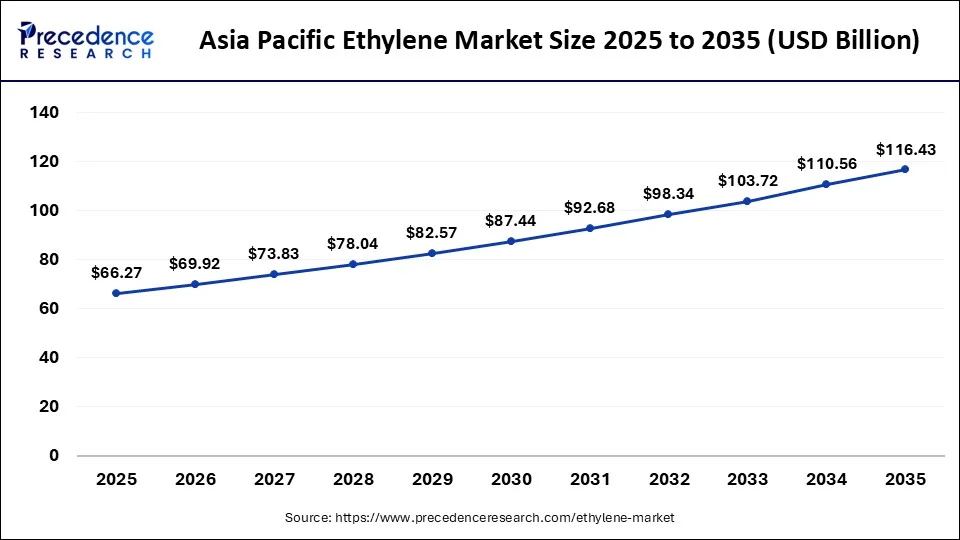

How Big is the Size of the Asia Pacific Ethylene Market in 2026?

According to Precedence Research, the Asia Pacific ethylene market size is projected to be worth around USD 116.43 billion by 2035, increasing from USD 66.27 billion in 2025, with a noteworthy CAGR of 5.80% from 2026 to 2035.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/2300

Why does Asia Pacific dominate the Ethylene Market?

Asia Pacific dominated the market in 2025. The presence of vast industrial infrastructure and the large-scale production of petrochemical products increases demand for ethylene. The growing demand for plastic products and the increasing petrochemical investment increase demand for ethylene. The increased purchasing of electronics and the rapid growth in online shopping increase demand for ethylene. The growing need for automotive components drives the market growth.

China Ethylene Market Trends

China's market is rapidly expanding production capacity as the country pushes for greater petrochemical self-sufficiency through large-scale new cracker projects and integrated refining-chemical complexes. Domestic demand continues to grow steadily, driven by packaging, construction, and automotive sectors, although it is increasingly being met by local supply rather than imports.

How is Europe experiencing the Fastest Growth in the Ethylene Industry?

Europe is experiencing the fastest growth in the market during the forecast period. The increasing use of lightweight components in vehicles and the rapid growth in advanced packaging increase demand for ethylene. The growing commercial construction activities and the well-developed petrochemical infrastructure increase demand for ethylene. The increasing investment in cracking technology and the rise in naphtha-based ethylene production support the overall market growth.

Germany Ethylene Market Trends

Germany's market is a key part of the European petrochemical industry, supported by strong downstream demand from automotive, packaging, and industrial manufacturing sectors. Growth remains modest, reflecting mature market conditions and weaker chemical demand across Europe. High energy and feedstock costs, along with strict environmental regulations, continue to pressure producers and have led to restructuring and capacity rationalization at older cracker facilities.

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com | +1 804 441 9344

Ethylene Market Segmentation

Source Insights

Why the Coal Segment Dominates the Ethylene Market?

The coal segment dominated the market in 2025. The presence of vast coal reserves and the expansion of coal-to-chemicals increases the adoption of coal. The increased production of ethylene glycol and the rapid expansion of plastic packaging increase demand for coal. The focus on enhancing energy security and the development of methanol-to-olefins pathways increases demand for coal, driving the overall market growth.

The natural gas segment is the fastest-growing in the market during the forecast period. The focus on the production of low-cost ethane and the increasing need for ethylene increases the adoption of natural gas. The development of large-scale ethylene plants and the increased consumption of polyethylene increase demand for natural gas. The innovation in natural gas extraction supports the overall market growth.

Feedstock Insights

How did the Ethane Segment hold the largest Share in the Ethylene Market?

The ethane segment held the largest revenue share in the market in 2025. The growing development of ethane-based infrastructure and the strong presence of shale gas increase demand for ethane. The high yield efficiency, cleaner production process, low carbon intensity, and abundance of ethane drive overall market growth.

The propane segment is experiencing the fastest growth in the market during the forecast period. The vast presence of natural gas liquids and the focus on minimizing carbon footprint increase demand for propane. The well-developed petrochemical infrastructure and the increasing need for the production of ethylene increase demand for propane. The lower cost and operational flexibility of propane support the overall market growth.

Application Insights

Which Application Segment Dominated the Ethylene Market?

The polyethylene segment dominated the market in 2025. The increasing use of food packaging films and the rising need for plastic pipes in construction increases demand for polyethylene. The increased spending on household goods and the rapid growth in the production of rigid containers increase demand for polyethylene. The packaging industry expansion drives the market growth.

The ethyl benzene segment is the fastest-growing in the market during the forecast period. The increasing need for durable plastic and the increased styrene manufacturing increase demand for ethylbenzene. The utilization of lightweight plastics in modern vehicles and the development of styrene-based foams increase demand for ethylbenzene. The expanding consumer goods industry fuels the overall market growth.

End-Use Insights

How did the Packaging Segment hold the Largest Share in the Ethylene Market?

The packaging segment held the largest revenue share in the market in 2025. The burgeoning e-commerce and the growing food delivery activities increase demand for ethylene. The shift towards hygienic packaging and the increasing awareness about sustainable packaging increases demand for ethylene. The increased production of packaging options like bags, bottles, films, closures, pouches, and containers increases demand for ethylene, driving the overall market growth.

The textiles segment is experiencing the fastest growth in the market during the forecast period. The increased utilization of polyester fibers and the changing trends of fashion increase demand for ethylene. The growing consumer demand for functional fabrics and the expanding fashion industry increase demand for ethylene. The increased use of household textiles and the expansion of technical textiles require ethylene, supporting the overall market growth.

Sales Channel Insights

Why Direct Import Segment Dominates the Ethylene Market?

The direct import segment dominated the market in 2025. The strong focus on lowering logistical costs and cheaper cost of raw material increases demand for direct imports. The high cost of ethylene production and the limited capacity of feedstock increase demand for direct imports. The focus on greater operational flexibility and the capacity constraints increases the adoption of direct import, driving the overall market growth.

The distributors & traders segment is the fastest-growing in the market during the forecast period. The higher demand for ethylene and the fluctuations in the prices of feedstocks increase demand for distributors & traders. The strong focus on managing logistics and the increasing need for high-value services increase demand for distributors and traders. The focus on enhancing customer experiences supports the market growth.

✚ Related Topics You May Find Useful:

➡️ Ethylene Glycols Market: Explore how industrial demand and sustainability trends are reshaping global chemical supply chains

➡️ Chlorinated Polyethylene Market: Analyze expanding applications in impact modifiers, coatings, and specialty elastomers

➡️ Ethylene Vinyl Acetate Market: Understand rising adoption across footwear, solar encapsulation, and flexible packaging

➡️ Chemistry 4.0 Market: See how digital transformation and smart manufacturing are redefining chemical production

➡️ Monoethylene Glycol Market: Track global demand shifts driven by textiles, PET resins, and automotive coolants

Ethylene Market Value Chain Analysis

-

Feedstock Procurement: Feedstock procurement focuses on acquiring feedstocks like naphtha, gas oils, butane, LPG, refinery gases, and ethane.

- Key Players:- SABIC, LyondellBasell Industries N.V., Chevron Phillips Chemical Company, Dow Chemical Co., INEOS Ltd.

-

Chemical Synthesis and Processing: Chemical synthesis focuses on steps like steam cracking, ODHE, methanol-to-Olefins, green ethylene, and laboratory synthesis. Chemical processing includes steps like compression of gases, removal of acid gases, distillation, and recycling.

- Key Players:- Dow, INEOS Group, Chevron Phillips Chemical Company, ExxonMobil Chemical, INEOS Group

-

Quality Testing and Certification: Quality testing measures attributes like impurity, odor, residues, moisture content, sulfur compounds, and density. Certifications like QCO, BIS, and ISO are required.

- Key Players:- TUV SUD, Intertek, SGS, Merieux NutriSciences, Bureau Veritas

Top Companies in the Ethylene Market & Their Offerings:

- BASF SE: Produces ethylene primarily for internal consumption to create high-value downstream chemicals and intermediates within its integrated "Verbund" system.

- Chevron Phillips Chemical Company, LLC: Operates as a major global merchant of ethylene and uses it to fuel its position as a leading producer of polyethylene resins.

- Exxon Mobil Corporation: Leverages massive refinery integration to produce ethylene for its high-performance plastics and specialty chemical portfolios.

- Dow: Maintains one of the world's largest ethylene production capacities to support its extensive global leadership in polyethylene and functional polymers.

- Sinopec: Acts as a dominant force in Asia, producing ethylene on a massive scale to meet China’s industrial demand for plastics and synthetic fibers.

- LyondellBasell: Utilizes a flexible feedstock strategy to produce ethylene for its global leadership in polyolefin technologies and licensing.

- INEOS Group: Focuses on large-scale ethylene production across Europe and North America to feed its diverse portfolio of solvents, resins, and plastics.

- SABIC: Utilizes low-cost feedstocks in Saudi Arabia and globally to produce ethylene as a foundation for its massive international chemicals and polymers business.

-

Shell plc: Produces ethylene within its integrated energy parks to provide building blocks for essential industrial chemicals like ethylene oxide and glycol.

Recent Developments

- In November 2024, Sinopec launched an ethylene complex in Tianjin, Northern China. The yearly production capacity of the plant is 1.2 million tons, and the plant focuses on producing petrochemical products. The complex focuses on the production of POE, LLDPE, and high-performance plastic. (Source: https://www.chemanalyst.com)

- In March 2024, New Energy Chemicals plans to provide biobased ethylene for Dow’s plastics. The ethylene is manufactured from agricultural residues and supports the production of renewable plastics. (Source: https://www.chemanalyst.com)

- In October 2025, Ras Lanuf Oil and Gas Processing Company announced the restarting of the initial phase of the ethylene plant. The plant aims to produce petrochemical products and offers the highest operational safety standards. (Source: https://libyaupdate.com)

Segments Covered in the Report

By Source

- Coal

- Natural Gas

- Hydrocarbon Steam Cracking

By Feedstock

- Naphtha

- Ethane

- Propane

- Butane

- Others

By Application

- Polyethylene

- High-density Polyethylene (HDPE)

- Linear Low-density Polyethylene (LLDPE)

- Low-Density Polyethylene (LDPE)

- Ethylene Oxide

- Ethyl Benzene

- Ethylene Dichloride

- Others

By End-Use

- Building & Construction

- Automotive

- Textiles

- Packaging

- Agrochemicals

- Others

By Sales Channel

- Direct Company Sale

- Direct Import

- Distributors & Traders

By Region

-

North America

- U.S.

- Canada

- Mexico

- Rest of North America

-

South America

- Brazil

- Argentina

- Rest of South America

-

Europe

-

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

-

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

-

Western Europe

-

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

-

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2300

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Chem and Materials | Towards FnB | Statifacts | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.